February 2025 Monthly Market Update

Key Themes: Equities Declined: Equities fell over the month following increased uncertainty as Donald Trump imposed new policies and economic data in the U.S. continued

Key Themes: Equities Declined: Equities fell over the month following increased uncertainty as Donald Trump imposed new policies and economic data in the U.S. continued

The pessimist complains about the wind; the optimist expects it to change; the realist adjusts the sails. As we ventured into 2025, global markets were

Key Themes: Equities rose: Both Australian and international equities rose in January. Australian equities rose as the December CPI report came in lower than expected.

Key points Equity Markets Close Off a Great Year for Investors: Despite a subdued end to the year and a Santa rally not materialising as

Key Themes: Equities fall: Both Australian equities and hedged international equities retreated in December. Australian equities fell on continuing uncertainty around China’s economic recovery and

Key Themes: Equities rose: Both Australian and international equities rose in November. US equities grew on expectations for policies under a Trump presidency that will

Division 293 tax is an additional 15% tax payable on concessional superannuation contributions (other than excess concessional contributions) made by or on behalf of high-income earners. Who

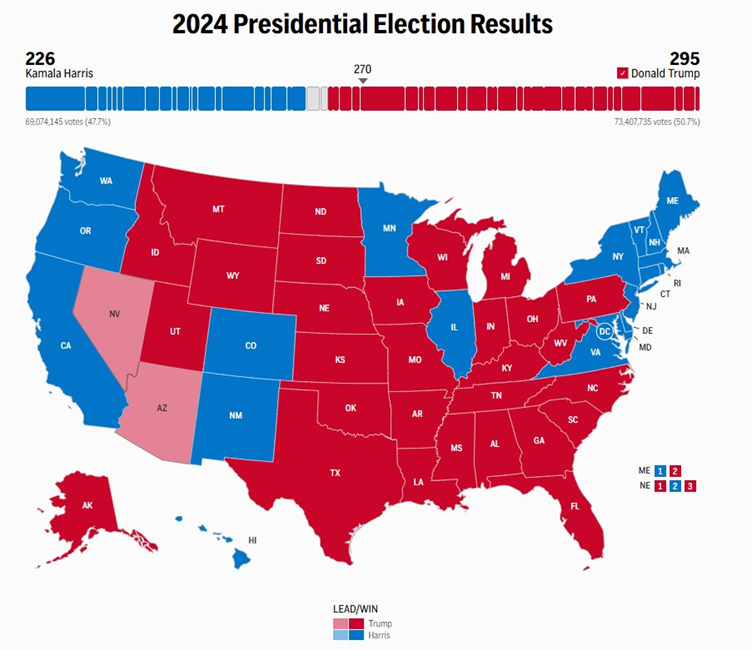

Donald Trump was elected the 47th President of the United States on Wednesday 6th November ensuring an unlikely political comeback after being voted out of office

Key Themes: Equities retreated: Both Australian and international equities fell in October while the market faced the looming U.S. election and rising bond yields which

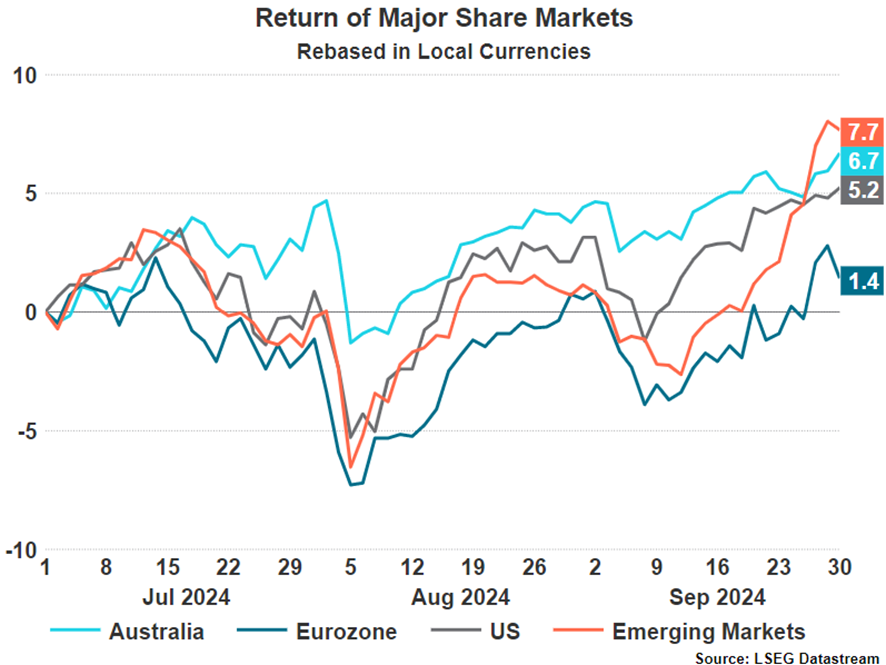

Equity All-Time Highs: Despite volatility caused by a spike in US unemployment and an unexpected rate hike in Japan, global equities continued to rise in

What is Total and Permanent Disablement (TPD) Insurance? TPD insurance aims to provide a lump sum payment if you suffer an illness or injury and

Superannuation Contribution caps apply to both concessional contributions and non-concessional contributions. The contributions caps that currently apply are: Contribution Type Age 2024-2025 Cap Concessional Contributions

A margin loan can be used to borrow for investment in shares or managed funds using the investments as security for the loan. Margin Lending

Dealing with Superannuation Death Benefits When a member of a superannuation fund passes away, their superannuation death benefit is cashed as soon as practicable. Depending

Upon attaining the preservation age condition of release, you can commence a Transition to Retirement (TTR) pension with your superannuation funds with preserved benefits or

From 1 July 2018 eligible people who sell their main residence may contribute up to $300,000 of the sale proceeds as a downsizer contribution to

What is Life Insurance and How Does it Work? The most common type of cover is life insurance (term life insurance). A life insurance policy

What is a Self Managed Super Fund A Self-Managed Superannuation Fund (SMSF) is a superannuation fund with up to six members. SMSFs are generally established

Superannuation can be used to start an account-based pension or an allocated pension once a person retires (or meets another condition of release). An Account

An Offset Account is technically a savings account linked to your mortgage / home loan and is works as a strategy to help pay down

Income Protection insurance aims to minimise the financial impact of sickness or injury by replacing income lost during a prolonged absence from work. A monthly

A managed fund, also known as mutual funds, is one type of ‘managed investment scheme’ (MIS), which is a professionally managed investment portfolio that pools

One of an extensive range of superannuation reforms the Federal Government announced in its 2016 Budget relates to the opportunity for eligible people to carry

If you are eligible for a Centrelink/Veterans’ Affairs payment, including the Age Pension, how much you receive will depend on an asset and income test assessment.

What is the Commonwealth Seniors Health Card The Commonwealth Seniors Health Care Card is a concession card to get cheaper health care and some discounts

Many superannuation funds allow their members to make a binding death benefit nomination. Trustees of a superannuation fund to act per a valid nomination, in the

A Power of Attorney is a legal document that allows another person to undertake specified activities on your behalf. This person should be someone you

A Will is a legal document that outlines your wishes for distributing your assets after your death. It will only deal with assets that end

Aged Care If you’re no longer able to continue living independently in your own home, you may need to move into a residential aged care

If you are eligible for a Centrelink/Veterans’ Affairs payment, such as the Age Pension, how much you receive depends on an income and assets test assessment. The

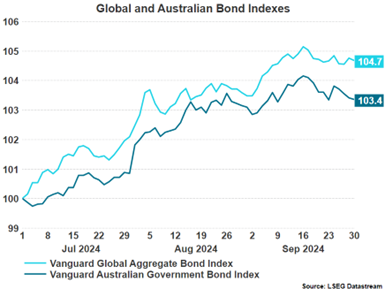

Key Themes: Equities made a significant recovery: Both international and Australian equity markets continued to grow despite a significant downturn at the start of the

What is a Means Tested Care Fee? A means-tested care fee is the extra contribution towards the cost of care that residents may need to

What is the Aged Care Basic Daily Care Fee? The Basic Daily Care Fee is payable by all people who receive residential care. This fee

Purpose of the Age Pension The Centrelink Age Pension is an income support payment by the government. The Centrelink Age Pension intends to ensure all

The government released the details of its proposed reforms for Aged Care last week. The changes will take effect on 1 July 2025, with existing

Estate Planning Estate planning is an important part of your overall financial plan to protect your family and yourself. This includes ensuring you have considered

Key Themes: Technology share rotation: Both international and Australian equity markets posted positive performance, as investors rotated out of tech stocks and into value and

A non-concessional contribution is a personal contribution a person makes to superannuation for their own benefit, or for the benefit of their spouse. Non-concessional contributions

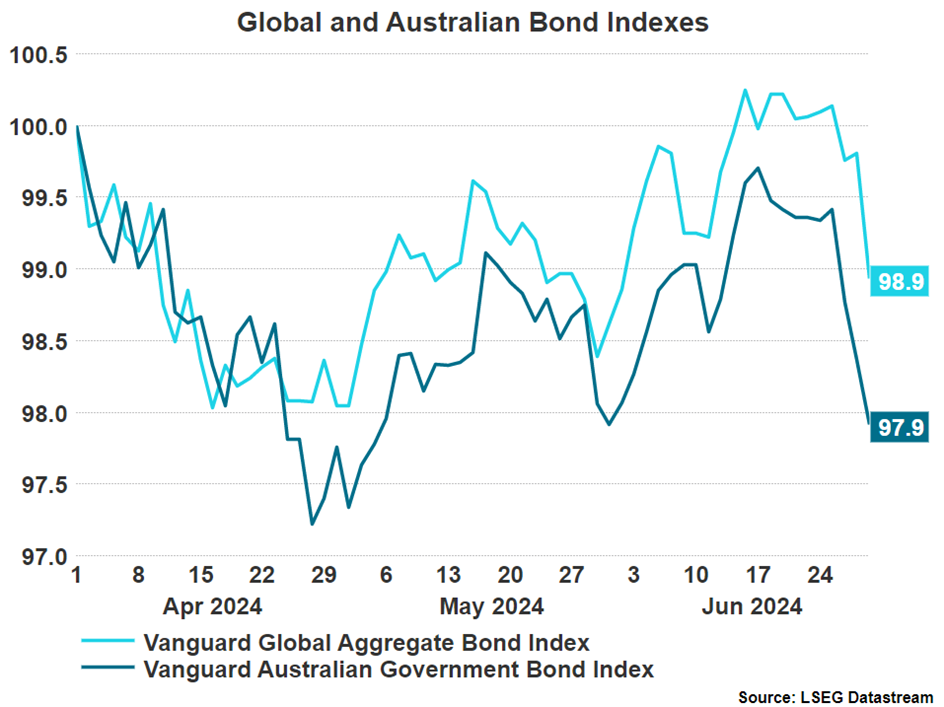

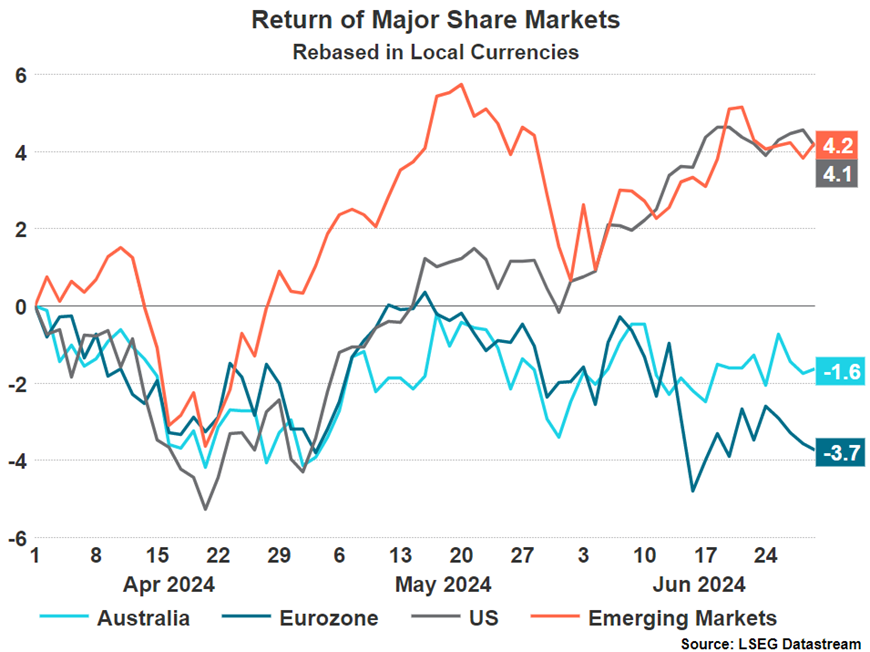

Key points Equity All-Time Highs: Global equities have continued to rise in Q2 2024, with many major equity markets reaching all-time highs. Australia failed to

You may pay for your Aged Care room. The Aged Care home sets the pricing for accommodation payment. Some people will have their accommodation costs

Superannuation Superannuation is your tax-advantaged way of saving for retirement, forming two of the three “pillars” of the Government’s retirement income policy, which are A

Concessional contributions are contributions made to a superannuation fund that are not treated as a non-concessional contributions. They are subject to yearly caps. They include Contributions

What is an ETF? An ETF or Exchange Traded Fund is an investment fund that typically aims to track an asset class or a basket of assets.

Gearing involves borrowing money to invest in assets that produce both income and good growth potential. This can help to build your wealth. Gearing involves

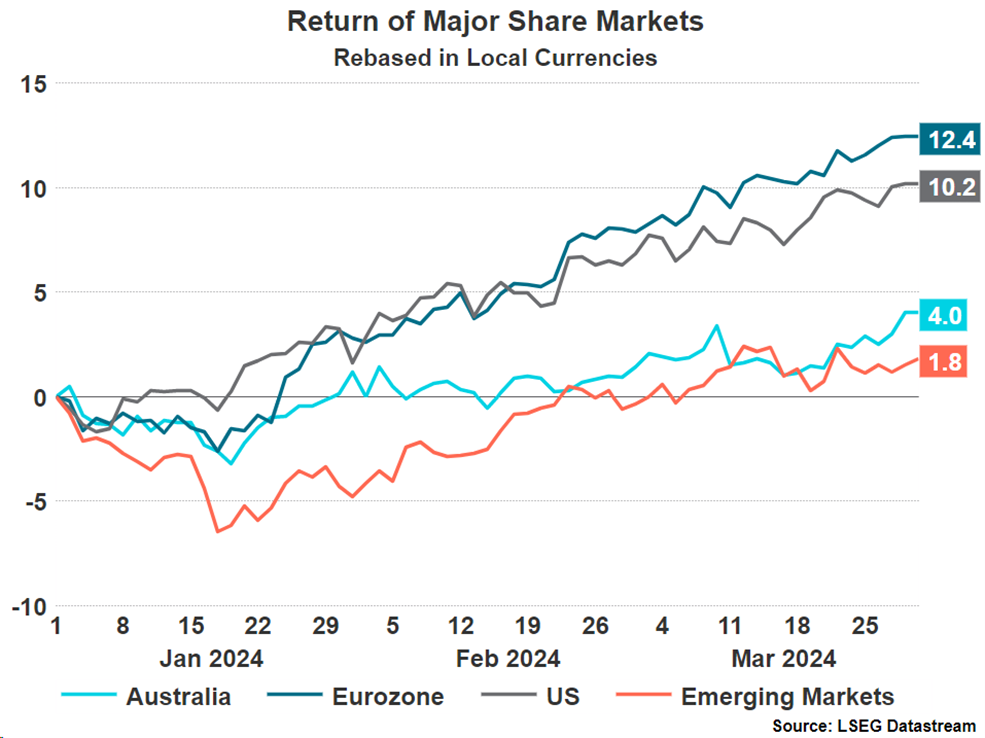

Equity All-Time Highs: Global and Australian equities have continued to rise in Q1 2024, with many major equity markets reaching all-time highs. Bond Split: Australian

What is a Discretionary Family Trust? A discretionary family trust is structure to hold assets in the name of an entity on behalf of family

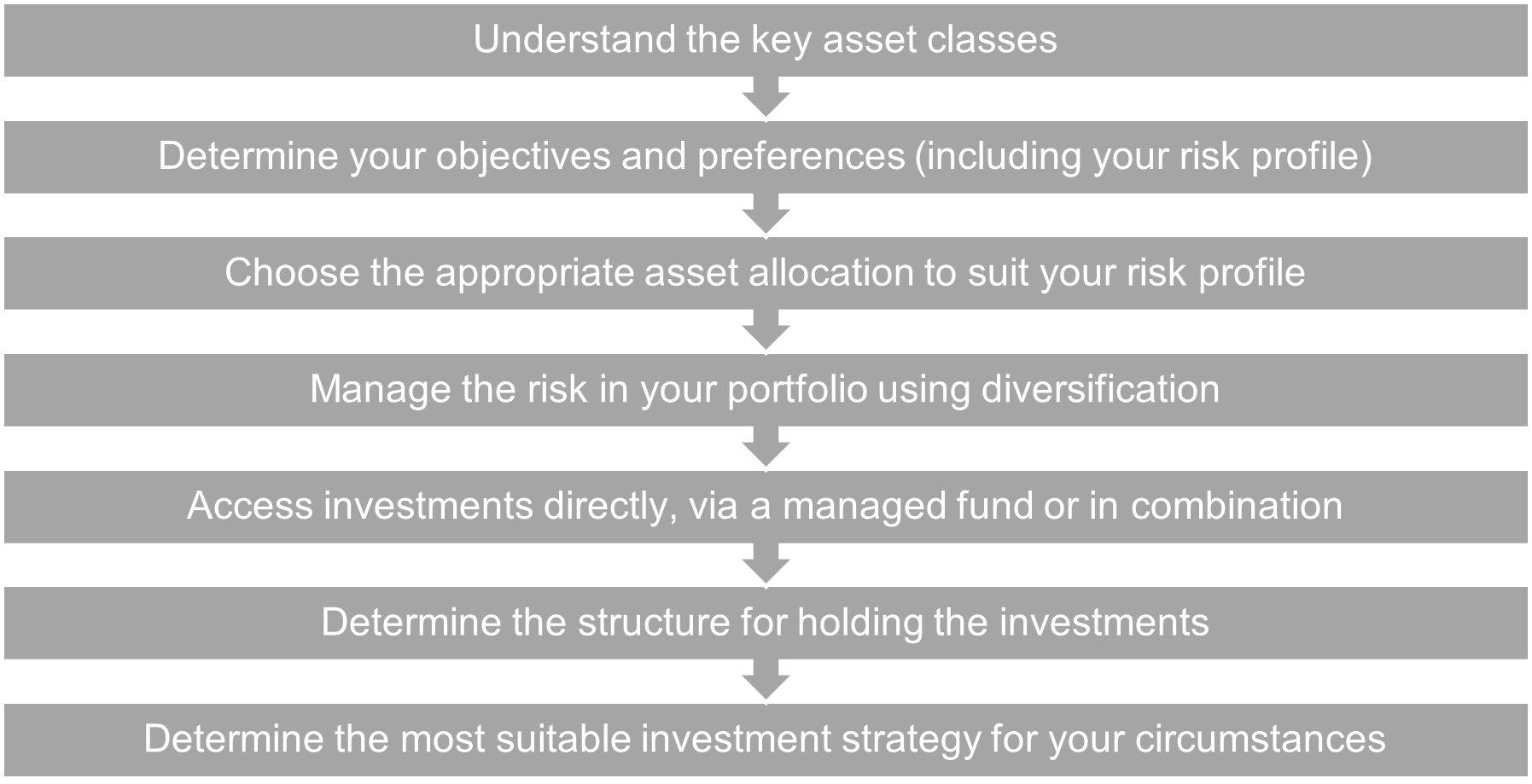

How to build an investment portfolio There are a number of steps to follow to building an investment portfolio that suits your financial goals and

Following strong returns for the 2021 calendar year where markets in US and in Australia were up north of 20%, the stock market has experienced

This podcast is a recent discussion with Chief Economist David Bassanese from BetaShares. David Bassanese is one of Australia’s leading economic and financial market analysts. He

Due to the Coronavirus pandemic, share markets around the world have seen unprecedented volatility in 2020. Market’s fell over 30% globally through February and March,