The pessimist complains about the wind; the optimist expects it to change; the realist adjusts the sails.

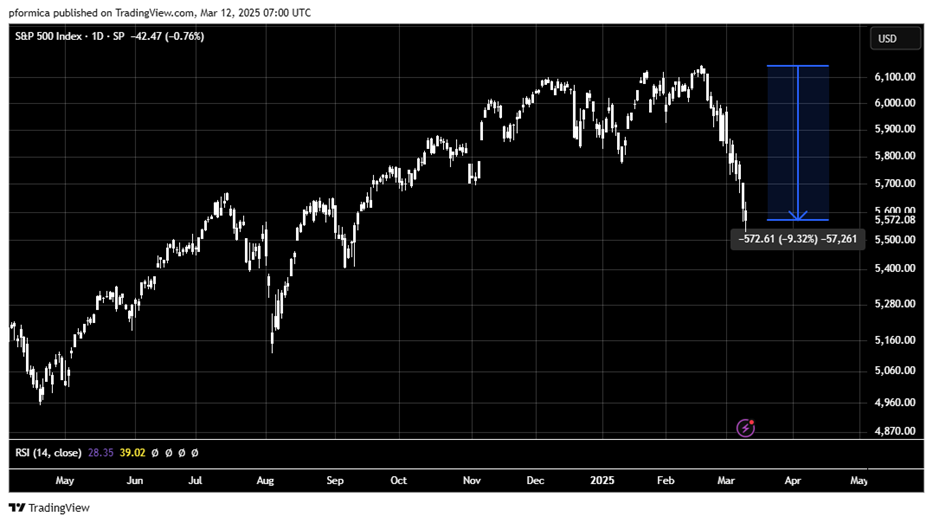

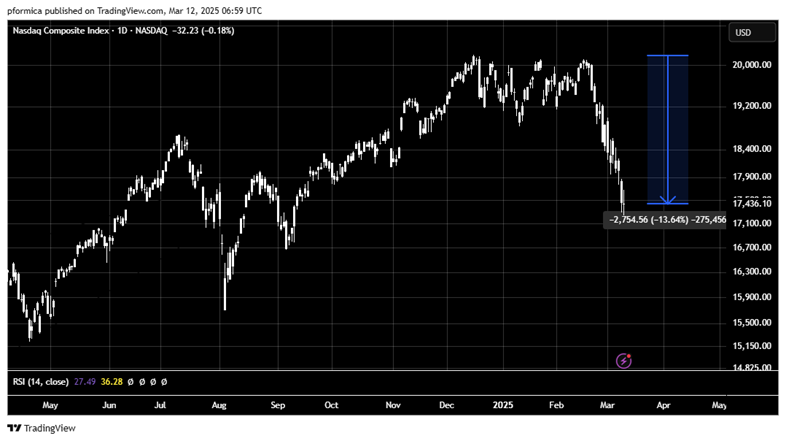

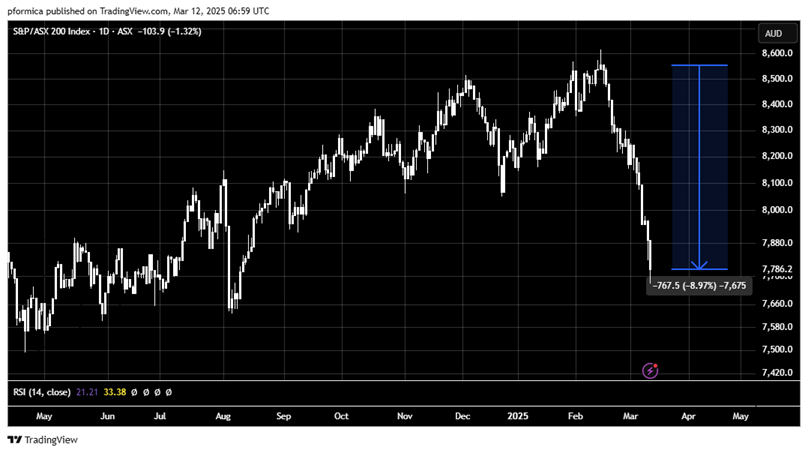

As we ventured into 2025, global markets were riding high on a wave of optimism. The U.S. stock market (S&P 500) delivered an total return of 25.66% in 2024, while the ASX 200 followed with a 11.20% return. February saw both indices reaching all-time highs, buoyed by investor confidence in the return of President Trump to the Oval Office, sparking hopes of business-friendly policies and economic growth.

Markets can be unpredictable, and the landscape has dramatically shifted in just a few short weeks.

Since its peak on the 19th of February, the S&P 500 has dropped 9%.

The NASDAQ—housing tech giants like Apple, Amazon, Microsoft, and Tesla—has fallen over 13%.

And the ASX 200 is down 9% from its peak.

So, what’s driving this pullback?

While market corrections are a normal part of the cycle, President Trump’s ‘America First’ promise, now becoming a reality has spooked financial markets and economic activity.

This is led by his implementation of Tariffs on foreign goods, as a tool in trade negotiations, aiming to secure what he considers better deals for the US, and as a way to promote and protect American industries and jobs.

Tariffs are essentially a form of tax on imported goods. They mean higher prices for consumers and cause economic disruption.

Within 2 months of being in the Oval Office, President Trump has already implemented a range of Tariff policies. This includes 25% tariffs on Mexico and Canada products, an additional 10% tariff on Chinese goods and a sweeping 25% tariff on steel and aluminium imports from all countries, including Australia, whose plea for an exception was denied.

Allies such as Canada and the EU have announced retaliatory tariffs on US imports. China has also imposed tariffs on a range of US exports.

Uncertainty about the impact of Tariffs and policy, together with a slew of weaker US Economic Data and fears of a recession, have spooked markets.

This was intensified when Trump noted that the US Economy may have a ‘period of transition’ while his policies take effect.

As mentioned, Trump’s return to office was met with joy and optimism by investors and businesses alike. However, recent developments has completely reversed this optimism, causing the recent fall in share markets.

Heading into 2025, we expressed to our clients that markets were stretched and vulnerable to any negative news. Therefore, we were actively positioning our clients’ portfolios for a pullback in markets. While a 10% market pullback is within the realm of normalcy, we are prepared for the possibility of an additional 5–10% downturn and are comfortable that our portfolios will continue to be able to weather this possibility. While we foresee another 5-10% downturn in markets, we believe any further deterioration in market conditions beyond this presents opportunities to adjust our portfolios.

On a final note, this is a reminder that markets are unpredictable. Corrections and pullbacks, while worrisome, are a healthy part of the market cycle. Selling shares or going more conservative on your superannuation and investment funds when share markets fall turns your paper loss into a real loss.

The best course of action is to remember to block out the noise, keep level headed and stick to your long term investment strategy.