Key points

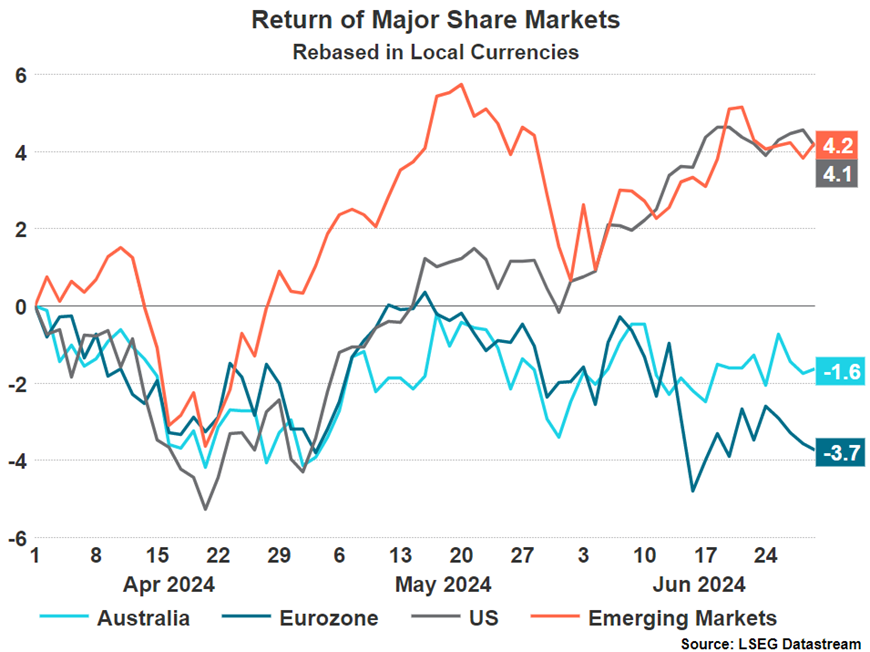

- Equity All-Time Highs: Global equities have continued to rise in Q2 2024, with many major equity markets reaching all-time highs. Australia failed to make new all time highs following inflation concerns.

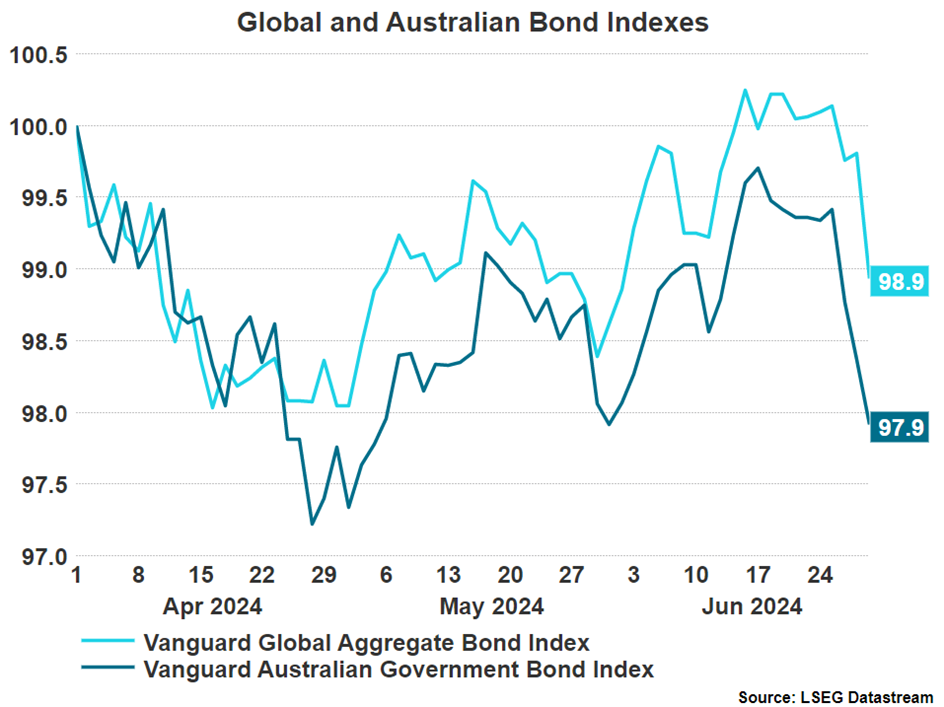

- Bond Mixed Performance: Australian bond yields rose following inflation worries. Global bond performance was mixed as rate cuts began in developed nations.

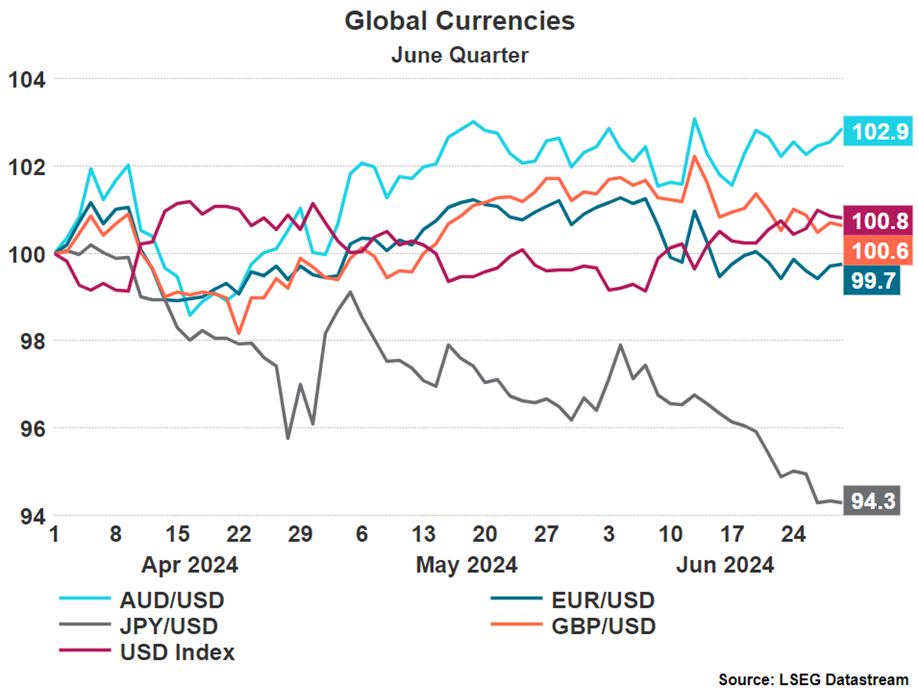

- US Dollar Remains Strong: The US Dollar remained stable. Currency movements were dictated by idiosyncratic events.

- Cautious 2024 Outlook: Expect market volatility. Recommend diversified equities and medium-duration bonds.

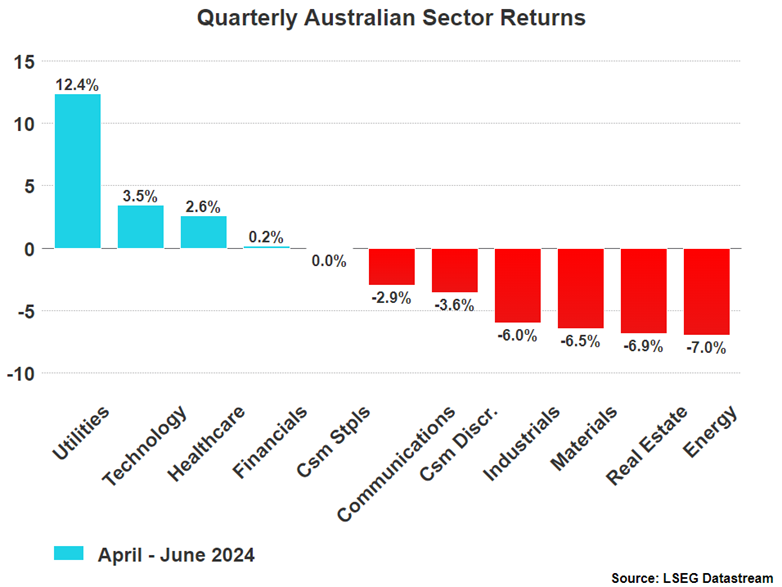

- Sector Performance: Once again Technology outshone the rest of the market globally. In Australia defensive sectors performed well as investors worry about the macro environment.

Markets in Review

Persistent inflation, international conflicts, elections in key nations, and continued high interest rates were all themes in the second quarter of 2024 but were unable to deter investors from another strong quarter. Once again, it was A.I. which led the charge and provided a tailwind for Q2 performance. At the end of the second quarter the Magnificent Seven posted gains of 18% whilst the other 493 companies which make up the S&P 500 were down 1% collectively. Although the US market ended up 4.1% for the quarter, it is important to recognise the dependence of the Tech/A.I. trend. Elsewhere emerging markets were the best performing sector; however, this was again driven by the A.I. theme via TSMC.

Fixed income had a mixed month as bond yields in many countries rose over the first half of the quarter following stronger than expected US inflation data but retreated in the second half off the back of cooler inflation data and long-awaited signs of a slowdown in the US economy. On home soil, Australian bond yields rose over Q2 due to a higher-than-expected CPI print, supporting fears of sticky inflation.

Equities

Australian markets experienced a volatile second quarter as investors digested several economic data releases. Most notably, CPI data in Australia which came in above expectations in all three months of the quarter which negatively impacted markets and resulted in the ASX 200 falling by 1.6%. The decline was led by the energy sector as it was negatively affected by ongoing conflicts and changes to supply/demand expectations which resulted in volatility in oil prices. Sticky inflation creating a higher for longer interest rate environment weighed on the property sector which subsequently also declined over the quarter.

Australian markets experienced a volatile second quarter as investors digested several economic data releases. Most notably, CPI data in Australia which came in above expectations in all three months of the quarter which negatively impacted markets and resulted in the ASX 200 falling by 1.6%. The decline was led by the energy sector as it was negatively affected by ongoing conflicts and changes to supply/demand expectations which resulted in volatility in oil prices. Sticky inflation creating a higher for longer interest rate environment weighed on the property sector which subsequently also declined over the quarter.

On the other hand, defensive sectors performed best as investors shift to a more cautious stance. This meant utilities gained 12.4% over the quarter while financials and healthcare also ended the period in the green. Following on from the global theme, technology posted positive performance as the A.I. trend continues to incentivise investors despite steep valuations.

Foreign Exchange Markets

Further signs of sticky inflation has led to investors pricing in a slower and shallower rate cutting cycle which has provided support to a strong US dollar. Over the past few years, it has been moves in the US dollar which has driven currency pairs, however over Q2 the US dollar finished not far from where we began at the start of April. Although strong, this stability in the US dollar gives way to idiosyncratic movements between currency pairs rather than broad currency moves.

The Australian dollar performed best over the period due to three consecutive months of hotter than expected inflation data which suggested to markets that rates in Australia will remain elevated for longer compared to its developed market counterparts. The Japanese Yen (JPY) depreciated most over the quarter, falling by 5.7%. Very low interest rates in Japan has had the effect of reducing the currency’s attractiveness when compared to its higher interest rate counterparts. This is further exacerbated by the narrative of sticky inflation holding rates in the US higher for longer.

Fixed Income Markets

Despite the volatility in the fixed income market, US treasury yields finished the quarter not far from where they started. Yields initially rose in April but fell in May following weaker than expected inflation data, however the recovery was quickly wiped out in June. Other developed markets followed suit and finished close to where the quarter began. Credit also finished slightly weaker which helped drive the Global Aggregate Bond Index lower.

Australian fixed income performed poorly over Q2 following three consecutive CPI prints which came in hotter than the market expected. This resulted in a spike in yields amid fears that the RBA will have to implement higher rates for longer, with some suggesting a further hike may even be needed to curb the persistent inflation.

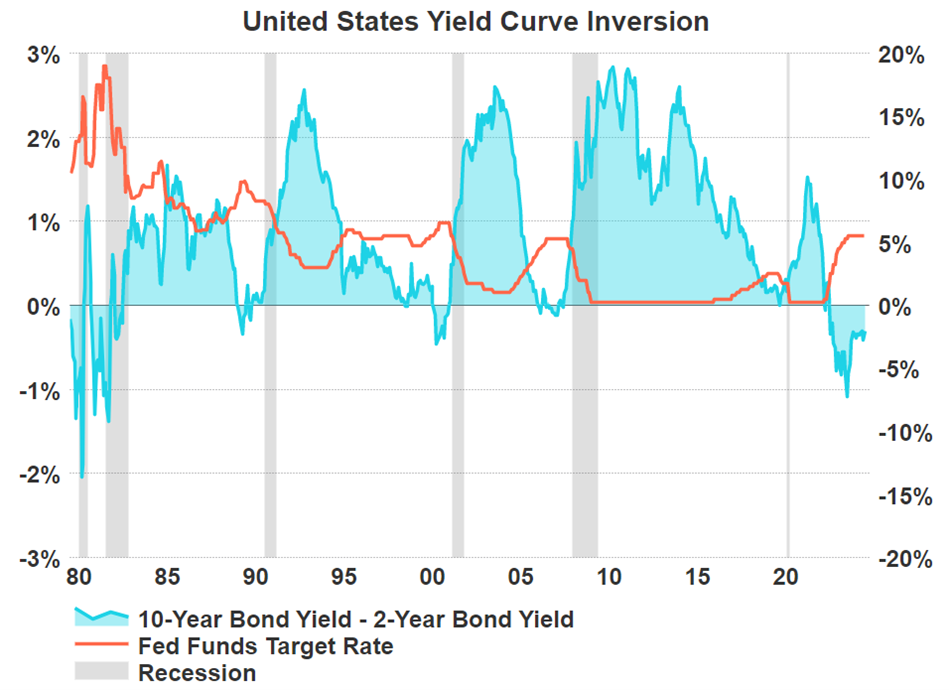

The US continues to have a yield curve inversion, the longest by far in the last 40 years. The inversion which was previously shrinking has slightly expanded again as the expected date of the first Federal Reserve rate cut continues to be delayed. A yield curve inversion is a common recession indicator in the US with every inversion in the past forty years being followed by a recession. With the latest inversion being longer than most that came before investors are waiting to see whether the indicator remains true.

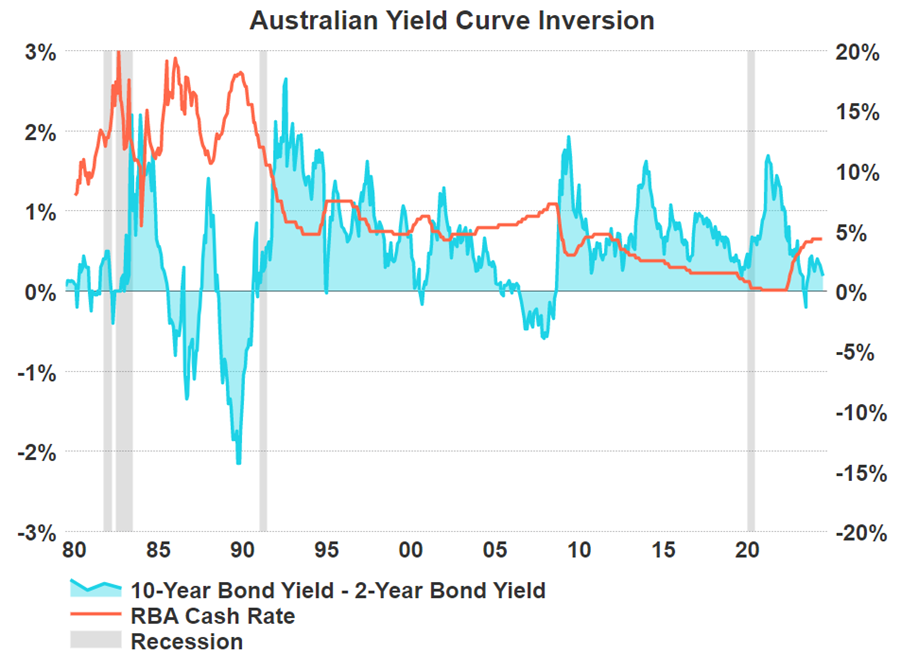

The Australian yield curve has normalised for quite some time now, but we are still waiting to see whether Australia will enter a recession or narrowly avoid one as inflation slows.

Outlook

Looking ahead to the rest of 2024, our outlook remains much the same as what we saw at the beginning of the year. At the start of the year, we noted that the market was pricing in rate cuts prematurely. This was off the back of persistent inflation and a strong US economy which meant the Federal Reserve had no reason to rush into a rate cut. With inflation close to the 3% mark, the market is now pricing in a 72.5% chance of the first cut in September. Although we are seeing a more compelling argument to begin the rate cutting cycle in the US, we still think that once again the market is being too optimistic, and a rate cut nearer to the end of the year is more realistic. As a result, we recommend a diversified equity allocation to avoid any downturns caused by unexpected decisions coming from the US Federal Reserve. Following such a strong first half of 2024 we think that it is unlikely that a full repeat will ensue, however with a rate cut in sight and strong corporate performance there is reason to be optimistic.

Globally we maintain our medium duration approach in fixed income which will capture returns from any falls in yield as the macroeconomic environment becomes more favourable for rate cuts, whilst locking in a healthy income in the meantime. In Australia we are slightly more cautious as CPI came in hotter than expected three readings in a row. As a result, a slightly shorter duration approach may be used, providing strong income until conditions look more favourable to take additional fixed income risk. Attractive yields mean credit markets also appear attractive however a selective approach should be taken to ensure that defaults are minimised in the event of an economic downturn off the back of unfavourable rate environment for business. We do not think high yield returns justify the risk.

Alternatives may be used in portfolios to improve diversification. Short term spikes in volatility following economic data releases gives opportunity to hedge fund type strategies which can capitalise on these moves. Private markets may be used for protection against short term market swings. Lastly, metals could also be used as a hedge against inflation whilst also benefitting from being a safe haven during periods of geo-political tension.

General Advice Warning

This update is issued by Ventura Investment Management Limited (AFSL 253045), which is a related body corporate of Centrepoint Alliance Limited.

The information provided is general advice only and does not take into account your financial circumstances, needs or objectives. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure Statement for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

For more information, refer to the Financial Services Guide (FSG) for Ventura Investment Management Limited (available at).

Disclaimer

While Centrepoint Alliance Limited and its related bodies corporate try to ensure that the content of this update is accurate, adequate, and complete, it does not represent or warrant its accuracy, adequacy or completeness. Centrepoint Alliance Limited is not responsible for any loss suffered as a result of or in relation of the use of this update. To the extent permitted by law, Centrepoint Alliance Limited excludes any liability, including negligence, for any loss, including indirect or consequential damages arising from or in relation to the use of this update.