Superannuation

Superannuation is your tax-advantaged way of saving for retirement, forming two of the three “pillars” of the Government’s retirement income policy, which are

- A Government funded means-tested age pension

- Compulsory superannuation contribution (i.e., the Superannuation Guarantee)

- Voluntary superannuation contributions

The Australian superannuation sector has become one of the world’s largest private pension funding arrangements, with assets exceeding $3.5 trillion as of December 2021.

Types of Funds

You have several different types of superannuation funds to choose from, with features varying in each category:

Retail Funds

Banks or investment companies usually run these; their general characteristic is as follows:

- Open membership to anyone,

- A wide range of investment options, sometimes in the hundreds,

- Mid to high cost, although some now offer low-cost alternatives,

- The company that owns the fund aims to retain some profit.

Industry Superannuation Fund

Usually open for anyone to join, though some are restricted to specific industries, these funds feature the following:

- A variety of investment options that will meet some people’s needs;

- Generally low to mid-cost, although some may have high fees,

- A ‘not for profit’ stance, with all profits reinvested for the benefit of members.

Public Sector Funds

Designed for employees of Federal and State government departments, most public sector funds are exclusive to government employees, offering:

- Some employers contribute more than the 10% minimum;

- A modest range of investment choices that will meet some people’s needs;

- Many long-term members have defined benefits, and newer members are usually in an accumulation fund;

- They generally have very low fees;

- Profits are put back into the fund for the benefit of all members.

Corporate Superannuation Funds

Arranged by an employer for its employees, these funds might be run directly by the employer or an industry fund and return all profits to members. If managed by a retail or industry fund, they can offer:

Features of these funds include:

- Funds run by the employer or an industry fund will return all profits to members. Corporate funds run by retail companies will retain some profits;

- If it is managed by a retail or industry fund it may offer a wide range of investment options;

- They are generally low to mid cost funds for large employers but may be high cost for small employers;

- Some older corporate funds have defined benefit members, most others are accumulation funds.

Self-Managed Superannuation Fund (SMSF)

SMSFs give you control over your superannuation investment decisions.

You can set up your own private superannuation fund and manage it yourself, but only under strict rules regulated by the Australian Taxation Office (ATO).

An SMSF can have one to four members. Each member is a trustee (or director if there is a corporate trustee).

If you set up an SMSF, you must:

- Carry out the role of trustee or director, which imposes important legal duties on you;

- Use the money only to provide retirement benefits;

- Set and follow an investment strategy that ensures the fund is likely to meet your retirement needs;

- Keep comprehensive records and arrange an annual audit by an approved SMSF auditor.

If you are running an SMSF, you will typically need:

- A large amount of money in the fund to make set up and yearly running costs worthwhile – usually at least $200,000;

- To budget for ongoing expenses such as professional accounting, tax, audit, legal and financial advice;

- Plenty of time and energy to manage the fund;

- Financial experience and skills so you are more likely to make sound investment decisions;

- Separate life insurance, including income protection and total and permanent disability cover.

Types of Contributions

Contributions to your superannuation fund can be

- concessional contributions, including employer contributions or personal contributions subject to a tax deduction,

- non-concessional contributions made by you, or for your spouse, or children under 18 years.

Components of a Superannuation Benefit

Your accumulated superannuation benefits consist of:

- taxable component

- tax-free component.

The tax-free component will generally comprise any non-concessional contributions they have made to the fund.

The taxable component comprises of concessional contributions and investment earnings that accrue from both concessional and non-concessional contributions.

When you start to draw an income stream from your superannuation fund, the taxable and tax-free components are crystallized when your pension commences. Future investment earnings are then apportioned between the taxable and tax-free components.

Taxation of Superannuation

Your superannuation is concessionally taxed but isn’t necessarily tax-free, except in certain situations. Here’s what this means for you:

- The non-concessional contributions you make aren’t taxed by your superannuation fund. However, if your non-concessional contributions exceed the cap, you will be taxed.

- Your concessional contributions are taxed as income at a 15% rate to the superannuation fund you contribute to. If your adjusted taxable income is more than $250,000 per annum, these contributions are taxed at a 30% rate, which is known as Division 293 tax.

- The income your superannuation fund earns on its investments is usually taxed at 15%. If the income is received by a pension or income stream, it’s tax-free to the fund.

- Capital gains your superannuation fund makes, assuming certain tax conditions are met, are also taxed as income to the fund but can be subject to a 33.33% discount. Capital gains from pension or income stream assets are generally tax-free to the fund.

- Lump-sum benefits your superannuation fund pays to its members are tax-free to the extent that the benefit comes from a tax-free component. Benefits with a taxable component are tax-free if paid after you reach age 60. If you are under 60, the tax-free component will be taxed on a sliding scale, based on your age at the time of withdrawal.

- When a benefit is paid as an income stream or pension, it will be tax-free once you reach age 60. The income streams paid to individuals under age 60 may be taxable, depending on the benefit’s components and your age when receiving the benefit.

- Members of older-style public sector superannuation and constitutionally protected funds have different taxation treatments.

Getting Money Out of Superannuation

Most of your superannuation benefits are preserved, meaning you can’t access them until you meet a “condition of release”. Common conditions of release include:.

- Attaining age 65;

- Retirement on or after reaching preservation age;

- Death;

- Diagnosis of a terminal illness;

- Permanent incapacity;

- Temporary incapacity;

- Reaching preservation age but not retiring;

- Severe financial hardship;

- Compassionate grounds.

Specific restrictions apply to releasing superannuation benefits on grounds of temporary incapacity, reaching preservation age but not having retired, and in cases of severe financial hardship and compassionate grounds.

The preservation age is 55 for people born before 1 July 1960. For those born after that date, the preservation age is progressively increasing to 60 years of age, as set out in the following table:

|

Date of Birth

|

Preservation Age

|

|---|---|

|

1 July 1960 – 30 June 1961

|

56

|

|

1 July 1961 – 30 June 1962

|

57

|

|

1 July 1962 – 30 June 1963

|

58

|

|

1 July 1963 – 30 June 1964

|

59

|

|

After 30 June 1964

|

60

|

Your benefits can be paid as a lump sum or an income stream, depending on your circumstances and the fund.

Lump Sum

If you are over 60, lump sum withdrawals are typically tax-free. However, as a public servant with untaxed super, you will likely pay tax.

Withdrawing a lump sum offers several benefits:

- You can clear debts or cover other necessary expenses, saving money in the long term.

- It allows you to invest outside of superannuation in simple savings or investment products like low-fee savings accounts, term deposits, or other investments that suit your needs. This could provide cash for your short to medium-term needs.

- The opportunity arises to afford things previously out of reach, such as travel, home improvements, or a new car.

The drawbacks, however, are as follows;

- The temptation to overspend or live beyond your means until the funds deplete.

- Spending now will decrease your retirement income later.

- Investments made outside superannuation might attract taxes on earnings, whereas they could grow tax-free in a retirement income stream.

Income Stream

An income stream is paid when you draw a pension from your superannuation fund or account.

The benefits of an income stream are:

- Pay less tax. By keeping your money in the superannuation system your investment earnings are tax-free, and for most people over 60, income payments are also tax-free;

- The flexibility to invest according to your timeline.

- Potentially extend your funds’ longevity by withdrawing them as an income stream instead of all at once.

The government mandates minimum annual withdrawal amounts from your income stream, based on your super balance at the financial year’s start and your age. For those starting a pension part-way through a year, this minimum is pro-rated.

There is no statutory maximum to the income you draw in a financial year unless your income stream is paid under the “transition to retirement” rules. Where you commence a pension at any time between your preservation age and age 65, and you have not retired, the maximum amount of income you can draw each year is limited to 10% of your pension account balance.

The following table shows the minimum income payment that must be made on an annual basis:

|

Age

|

Income Factor - Standard

|

|---|---|

|

Under 65

|

4%

|

|

65 – 74

|

5%

|

|

75 – 79

|

6%

|

|

80 – 84

|

7%

|

|

85 – 89

|

9%

|

|

90 – 94

|

11%

|

|

95 and over

|

14%

|

Concessional Contributions

Concessional Contributions (also referred to as pre-tax contributions) include:

- Employer super guarantee contributions (11.50% for the 2024-2025 financial year)

- Salary Sacrifice Arrangements you might enter into

- Personal Contributions where you claim a personal tax deduction.

- Contributions you make for relatives (other than your spouse) and your children over 18, whether or not you are eligible to claim a tax deduction.

Concessional Contributions Cap

The concessional contributions cap limits the concessional contributions you make to super. For the 2024/2025 financial year, your concessional contribution cap is $30,000 per annum.

|

Financial Year

|

Cap Amount

|

|---|---|

|

2024-25

|

$30,000

|

|

2023-24

|

$27,500

|

|

2022-23

|

$27,500

|

|

2021-22

|

$27,500

|

|

2020-21

|

$25,000

|

|

2019-20

|

$25,000

|

|

2018-19

|

$25,000

|

The basic concessional contributions cap is indexed to average weekly ordinary time earnings (AWOTE) each financial year but only increases in increments of $2,500.

Concessional Contribution Carry Forward Rule

From 1 July 2018, the unused portion of your concessional contribution cap that accrues from 1 July 2019 can be carried forward for up to 5 years.

This measure only applies if your total superannuation balance at the end of the previous financial year is less than $500,000.

Elaine has a total superannuation balance of less than $500,000 as at 30 June 2024.

Her employer made concessional contributions of $8,000 in the 2023-24 financial year. She also made a personal tax-deductible contribution of $2,000, bringing her concessional contributions for the year to $10,000.

Elaine’s unused concessional contribution cap is $17,500 (i.e. $27,500, less $10,000).

She can carry the unused portion of her concessional contribution cap forward for up to 5 years.

This means that in 2024-25, the maximum concessional contributions that could be made, provided her total superannuation balance as at 30 June 2024 was less than $500,000, are $47,500 (the basic $30,000 concessional contribution cap, plus $17,500 carried forward from 2023-24).

Note: For the sake of simplicity, the unused concessional contribution cap from years prior to 2022-23 have been ignored in this example.

Eligibility to make Concessional Contributions

|

Age

|

Contribution Requirements

|

|---|---|

|

Under age 18

|

If they have derived income during the year from employment or carrying on a business.

|

|

Between age 67 and 74

|

Need to meet work test

|

|

Age 75 and over

|

Concessional contributions cannot generally be made after the 28th day of the month following that in which a person turns 75

|

The Work Test

To meet the work test requirement, you must have been gainfully employed for at least 40 hours within a 30-consecutive day period in the financial year before you make the contribution. Typically, this work should have been completed before making the contribution.

Your employer’s mandated contributions, such as super guarantee contributions, can be made regardless of age.

Taxation of concessional contributions

Concessional contributions are treated as assessable income of the super fund to which they are made. They are taxed within the fund at a rate of 15%.

Div 293 Tax

If you are a high-income earner, earning more than $250,000 per annum, you will pay an additional tax of 15% on your concessional contributions under Division 293 tax. This tax is levied on you personally, rather than on your super fund. For Division 293 purposes, your income includes your taxable income, amounts subject to family trust distribution tax, reportable fringe benefits, net investment losses, and ‘low tax contributions’.

Low-rate contributions fall within the concessional contribution cap and exclude any excess contributions.

Excess concessional contributions

The Australian Taxation Office will issue an excess concessional contribution determination when the concessional contribution cap is exceeded.

If you exceed your concessional contribution cap, the Australian Taxation Office will send you an excess concessional contribution determination. The excess will be included in your assessable income and taxed at your marginal tax rate, with a non-refundable 15% tax offset to account for the tax already paid by your super fund. Any remaining amount after tax will be returned to you. You can choose to have 85% of your excess concessional contributions released from your super. Excess contributions not withdrawn are counted towards your non-concessional contribution cap.

Salary sacrifice arrangements

A salary sacrifice arrangement includes an employee forgoing a part of their remuneration in return for the employer providing additional contributions into super.

The basic requirements for a salary sacrifice arrangement to be effective include:

- The arrangement must be established before any work that gives rise to remuneration is performed.

- There must be an agreement in place between the employer and the employee. Preferably, the agreement should be in writing.

A salary sacrifice arrangement is an effective way to reduce an employee’s taxable income. For example, if an individual on a $80,000 gross salary agrees with their employer to salary sacrifice $100 per week ($5,200 pa), their PAYG tax could reduce by $1,664 pa. After considering contributions tax of $780, there is an overall tax saving of $884

Low income superannuation tax offset (LISTO)

If you are a low-income earner, with an adjusted taxable income of less than $37,000, you are eligible for the low income superannuation tax offset (LISTO), which refunds the contributions tax on the first $3,333 of your concessional contributions, up to $500 per year, credited automatically to your super account.

To qualify, at least 10% of your total income must come from employment or self-employment.

Non-Concessional Contributions

Non-concessional contributions (also referred to as after-tax contributions) include

- Personal contribution made from after tax money

- Contribution made for the benefit of a spouse or children under 18 years old.

Non-concessional contributions are generally made from after-tax income, from savings, and from the sale of other investments and assets. Non-concessional contributions may also be made from inheritances, gifts, and windfalls.

Non-concessional contributions can be made up until the 28th day of the month following that in which they turned 75.

Non-Concessional Contributions Cap

The non-concessional contributions cap limits the non-concessional contributions you can make to your super. The non-concessional contribution cap for the 2024/2025 financial year is $120,000 per annum. However, you may be able to make up to three years of contributions in a single year under certain circumstances.

You can only make non-concessional contributions if your total superannuation balance is less than $1.9m.

|

Financial Year

|

Cap Amount

|

If Total Superannuation Balance is:

|

|---|---|---|

|

2024-25

|

$120,000

|

Less than $1.9 million at 30 June 2024

|

|

2023-24

|

$110,000

|

Less than $1.9 million at 30 June 2023

|

|

2022-23

|

$100,000

|

Less than $1.7 million at 30 June 2022

|

Total Superannuation Balance

Your total superannuation balance is the sum of all amounts you have in superannuation on the previous 30 June, including amounts held in both accumulation accounts and accounts paying a pension or income stream. Special rules apply if you are a member of a defined benefit or constitutionally protected fund to determine your total superannuation balance.

Three-year bring forward rule

Members under age 75 at any time in a financial year may bring forward up to two years’ worth of non-concessional contributions cap that income year, allowing them to potentially contribute up to $360,000 in the 2024/2025 financial year. This is known as the ‘bring-forward rule’.

The three-year bring forward rule is triggered when non-concessional contributions in a financial year exceed $120,000.

If triggered in a previous year, the remaining balance of the three-year cap may be contributed, subject to meeting the general rules relating to contributions, including having a total superannuation balance of less than $1,900,000.

If your total superannuation balance is $1,660,000 or more, the amount you can contribute under the three-year bring-forward rule is scaled back.

|

Total Superannuation Balance

|

Maximum Non-Concessional Contribution

|

|---|---|

|

Less than $1,660,000

|

$120,000 + 2 years = $360,000

|

|

$1,660,000 to $1,779,999

|

$120,000 + 1 year = $240,000

|

|

$1,780,000 to $1,899,999

|

$120,000

|

|

$1,900,000 or more

|

$0

|

Taxation of Non-Concessional Contributions

When a non-concessional contribution is made to your superannuation fund, it is not taxable in the fund.

Non-concessional contributions form part of your tax-free component within super. When the tax-free component is paid out as either a lump sum or as an income stream, the benefit is tax-free in your hands.

Investment earnings that accrue on the tax-free component of a benefit are added to the taxable component where the fund is in the accumulation phase and are apportioned between your taxable and tax-free components when the fund is paying an income stream.

Exceeding the Non-Concessional Contributions cap

If your non-concessional contributions exceed the allowable cap, the Australian Taxation Office will issue an excess non-concessional contribution determination.

If you elect to withdraw the excess non-concessional contribution and associated earnings, which are taxed at your marginal tax rate, no other penalty is applied. A 15% tax offset is provided to compensate for the tax paid by the superannuation fund on the associated earnings.

If an election is not made within the prescribed time (within 60 days of the date the determination was issued), the Australian Taxation Office will tax the excess non-concessional contributions at a rate of 47%. The Australian Taxation Office has the power to order the compulsory release of excess non-concessional contributions from superannuation if the election is not made by you, the member of the fund.

The Australian Taxation Office has the power to order the compulsory release of excess non-concessional contributions from superannuation, where the election is not made by the member of the fund.

Benefits of Non-Concessional Contributions

Making non-concessional contributions to your superannuation can increase your retirement savings and add to your tax-free component.

This may result in you receiving a tax-free lump sum and income stream benefits from your fund. If you, pass away, the tax-free portion of your accumulated savings is tax-free when paid to your legal personal representative (i.e., your Estate) or directly to other non-dependant beneficiaries.

You may be eligible to receive a Government co-contribution and/or the spouse contribution tax offset if you make a non-concesisonal contribution.

Downsizer Contributions

If you are aged 55 or over and choose to sell your main residence, you can contribute up to $300,000 of the sale proceeds to your superannuation without being restricted by the usual limitations, including age barriers and contribution caps, that typically apply to such contributions.

The contributions you make under these circumstances are known as ‘downsizer contributions’ and they follow a specific set of rules. These downsizer contributions are treated independently from concessional and non-concessional contributions.

How do Downsizer Contributions work?

To be eligible to make downsizer contributions, you need to meet several criteria:

- You must be aged 55 or above,

- Your contributions should come from the sale of a property that was your main residence for capital gains tax purposes at some point during your ownership,

- You, or your spouse, must have owned the residence for no less than 10 years,

- You must make the contribution of up to $300,000 from the sale proceeds within 90 days following the change of ownership (settlement),

- You should not have previously made a downsizer contribution.

Qualifying residence rule

For your sale proceeds to qualify as a downsizer contribution, the property sold must, at some time during its ownership, have qualified for a capital gains tax exemption as your main residence or that of your spouse.

Thus, sale proceeds originating from commercial properties, or investment properties that never qualified as your main residence for capital gains tax purposes, are ineligible for downsizer contributions.

Moreover, a qualifying residence does not include houseboats, caravans, or mobile homes.

Opting for a downsizer contribution requires selling a qualifying property. However, you don’t need to purchase another residence afterwards. For instance, if you plan to rent, move into a retirement village or aged care facility, or live with family post-sale, you are still eligible to make a downsizer contribution.

How are downsizer contributions treated?

A downsizer contribution will form part of your tax-free component within your superannuation, meaning it is not taxed upon contribution to your super fund.

While downsizer contributions do not count as non-concessional contributions, they contribute to your total super balance.

Downsizer Contributions and Transfer balance cap and taxation

The transfer balance cap, currently at $1.9 million, limits the amount you can transfer to a super income stream or pension.

Consequently, even though you can make a downsizer contribution, the contribution may not be able to be transferred to a pension account if you have already exhausted the transfer balance cap. While the downsizer contribution remains in a super accumulation account, the investment earnings that accrue on the contribution will be taxed within the super fund at a rate of 15%. This contrasts with the retirement phase, where the investment earnings from super benefits that support an income stream or pension are exempt from tax at the fund level.

Additionally, earnings on an accumulation account are part of your taxable component, which can have tax implications if your super benefit passes to a ‘non-tax dependent’, like an adult child, upon your death. In contrast, if downsizer contributions are applied to a retirement phase pension, the earnings are tax-exempt and become part of your tax-free component.

Downsizer Contributions and Social Security

Your main residence is normally exempt from assets and income tests for Social Security and Department of Veterans Affairs benefits, including age or service pensions. However, selling your main residence and transferring the surplus proceeds into a bank account, investing it elsewhere, or making a downsizer contribution to super may cause these funds to be included in assets and income tests. This could result in a reduction or loss of pension payments.

Withdrawing Lump Sums From Superannuation

You can only access your money in superannuation once you meet a condition of release, such as retirement. At that point, you can choose to leave it in superannuation, take a lump sum or start an income stream.

Before withdrawing, you should consider costs such as tax and withdrawal fees. Working with your adviser in advance to look at effective strategies may allow you to manage your tax liability and gain the most value from your hard-earned savings.

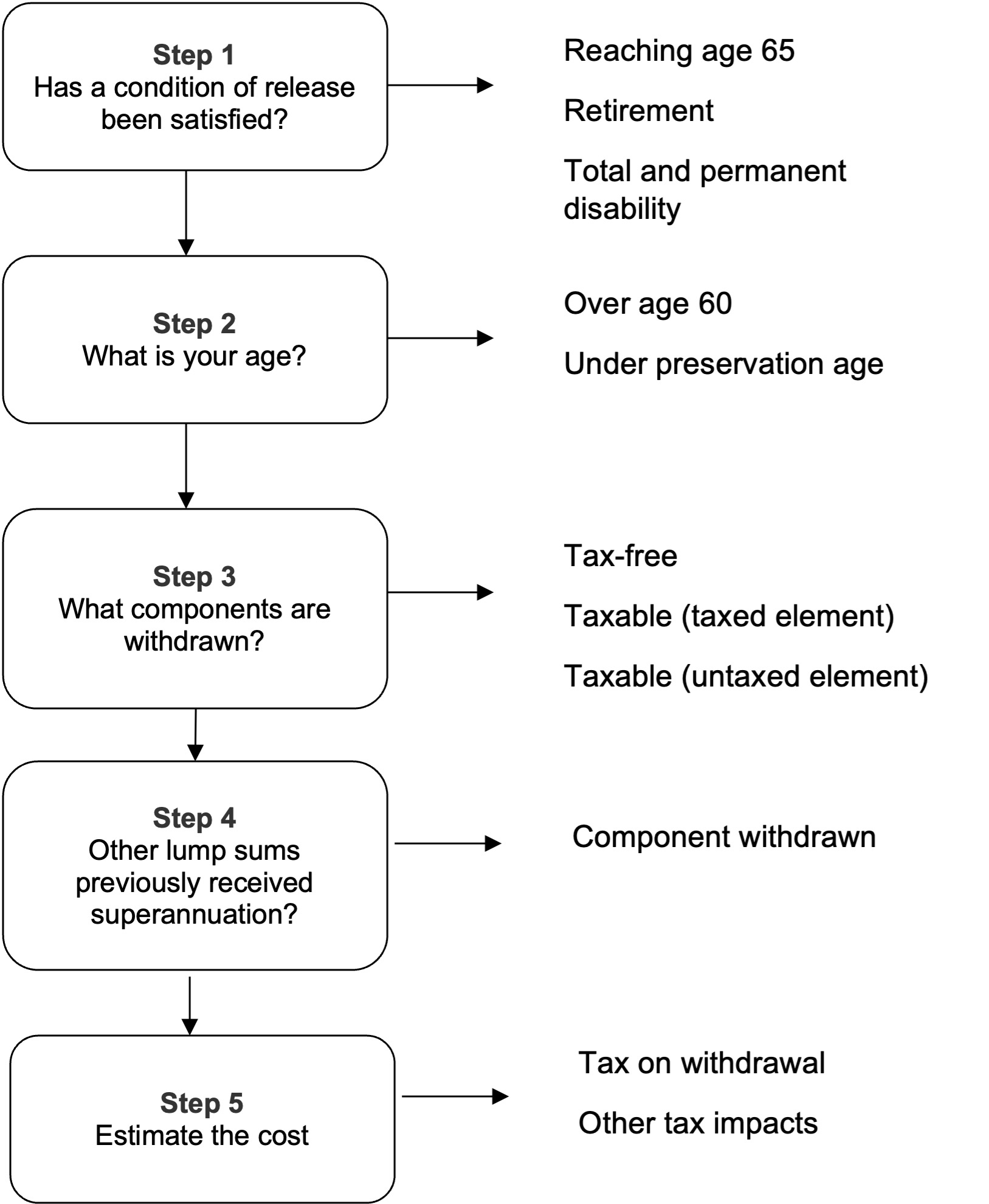

The Steps for Making a Lump Sum Withdrawal

When deciding to take a lump sum out of super, there are several steps to determine if this is the right approach and what impact the withdrawal will have. This is shown in the following diagram, with each step discussed below.

Step 1 – Conditions of Release

Your superannuation can only be accessed when you have satisfied a condition of release. The withdrawal request must be sent to the superannuation trustee in writing. It may need to be supported by a statement or evidence that you have satisfied a condition of release.

There are several conditions of release, but the three main ones are discussed here. For other situations, you should discuss your circumstances with your adviser.

Reaching age 65

From age 65, you can access all your superannuations, even if you are still working (unless your employer fund has restrictions).

Retirement

The definition of retirement requires you to be over your preservation age and permanently retired (i.e., do not intend to work again for 10 or more hours in any week). Preservation age is gradually increasing, as shown:

|

Date of Birth

|

Preservation Age

|

|---|---|

|

Before 1 July 1960

|

55

|

|

1 July 1960 – 30 June 1961

|

56

|

|

1 July 1961 – 30 June 1962

|

57

|

|

1 July 1962 – 30 June 1963

|

58

|

|

1 July 1963 – 30 June 1964

|

59

|

|

1 July 1964 or later

|

60

|

If you stop a job after you reach age 60, you can access your superannuation even if you intend to keep working at another job.

Permanent incapacity

You may access your superannuation if you become totally and permanently incapacitated. This will require doctors to verify that you are unlikely to be able to work again.

Step 2 – Your Age

Your age is relevant for determining conditions of release (in Step 1) and the taxation that will apply (Step 5). Your age is measured as the age at the withdrawal time.

Step 3 – Components of your Superannuation

Superannuation savings are split into three tax components. You may have one or more of the following components in your fund:

- Tax-free component

- Taxable component – element taxed

- Taxable component – element untaxed

Each withdrawal you make will be split proportionally across each component. The tax rules vary for each component depending on your age, as shown below.

Step 4 – Previous Withdrawals

If you are making a withdrawal under age 60 we need to check what other withdrawals you have made from your superannuation savings (across all accounts) as this may affect the tax you pay on any new withdrawals.

Step 5 – Estimate the Cost

Depending on your age and the tax components, you may pay tax on withdrawals from superannuation.

Over age 60

If you are age 60 or over the tax on lump sum withdrawals is shown in the table below for the 2024/25 financial year.

|

Component

|

Threshold

|

Tax rate

|

|---|---|---|

|

Tax-free

|

All

|

0%

|

|

Taxable (element taxed)

|

All

|

0%

|

|

Taxable (element untaxed)

|

Up to $1,780,000

Over $1,780,000 |

15%*

45%* |

*Plus Medicare Levy

Under your preservation age

Unless you are permanently incapacitated, you generally cannot access your superannuation under preservation age.

If you are under your preservation age, the tax on lump sum withdrawals is shown in the table below for the 2024/25 financial year.

|

Component

|

Threshold

|

Tax rate

|

|---|---|---|

|

Tax-free

|

All

|

0%

|

|

Taxable (element taxed)

|

All

|

20%

|

|

Taxable (element untaxed)

|

Up to $1,780,000

Over $1,780,000 |

30%*

45%* |

*Plus, Medicare Levy

If you withdraw a taxable component and tax is paid on this amount, it is added to your assessable income and may impact your entitlement to other tax offsets or benefits. This may mean you pay more tax than expected on other income that year.

Death Benefits

Dealing with Superannuation Death Benefits

If you have a superannuation fund and pass away, any benefits you have within your super must be cashed out as soon as reasonably possible.

When you pass away, your super doesn’t automatically become part of your estate. However, you can choose to have your super death benefit included in your estate by completing either a binding or non-lapsing death benefit nomination in favor of your legal personal representative (LPR).

Who Can a Superannuation Death Benefit be paid to?

The superannuation death benefit can only be paid out to your dependents (as defined by superannuation law) or to your estate.

A dependent includes:

- Your current spouse (including de facto and same-sex partners),

- Any of your children (including adopted children or stepchildren from your current relationship),

- Someone with whom you had an interdependency relationship at the time of your death,

- Someone who was financially dependent on you at the time of your death.

If you don’t have any superannuation dependents or an estate, the super death benefit can be paid out to another person. It’s worth noting that a stepchild from a previous relationship (after a relationship breakdown or death) isn’t considered a dependent for superannuation purposes unless they were financially dependent on you or had an interdependency relationship with you.

An interdependency relationship is considered to exist if you and another person:

- Had a close personal relationship,

- Lived together (unless separation was due to disability),

- Each provided the other with financial support, and

- Each provided the other with domestic support and personal care.

How Can a Death Benefit be paid?

Your super death benefit can be paid as either a lump sum or an income stream, based on your superannuation fund’s rules and the beneficiary’s status.

If the benefit is paid to a child, an income stream (pension) can only continue if the child is under 18, or aged 18-25 and financially dependent on you, or meets disability criteria. Unless the child meets these criteria, the pension must stop and be converted into a lump sum when they reach 25. This lump sum is tax-free.

Death Benefit Nominations

There are two ways you can nominate a beneficiary for your super death benefit from the accumulation phase:

- Binding death benefit nomination, or

- Non-binding death benefit nomination

The option you can choose depends on what your superannuation fund allows.

Generally, the trustee of the fund has the discretion to decide who benefits are paid to, but a binding or reversionary nomination can override this discretion.

For a binding death benefit nomination to be effective, it must:

- Be made in writing,

- Be witnessed by two people over the age of 18 who are not beneficiaries,

- Nominate beneficiaries who are considered dependents under super law,

- Clearly allocate benefits among the beneficiaries,

- Be current (with many funds requiring renewal at least every three years, though some offer non-lapsing options).

For a self-managed super fund (SMSF), the rules regarding binding nominations might differ based on the fund’s trust deed.

A non-binding death benefit nomination indicates your preference for how the death benefit should be paid, but it’s not mandatory for the trustee to follow this. The trustee will consider your wishes but ultimately has the discretion to decide the beneficiary and the form of payment. If a binding nomination is deemed invalid, it’s treated as if it were a non-binding nomination.

If you have named a beneficiary as a reversionary pensioner, the income stream you were receiving will continue to be paid to them after your death.

Taxation of Superannuation Death Benefits

Dependant Beneficiary

Super death benefits paid as a lump sum are tax-free if going to a beneficiary who qualifies as a dependent for tax purposes. This includes:

- Your current or former spouse (including de facto and same-sex partners),

- A child under 18, or between 18-25 and in full-time education,

- Someone with whom you had an interdependency relationship at the time of your death,

- Someone who was financially dependent on you at the time of your death.

If the benefit is paid to your estate, the tax implications depend on who ultimately inherits the benefit. Super death benefits paid to adult children will be taxable unless the beneficiary qualifies as a dependent under the criteria mentioned.

Non-Dependant Beneficiary

The following table lists the tax rates payable on lump sum death benefits paid to a non-tax dependent beneficiary.

The Medicare Levy, where applicable, will be additional if the benefit is paid directly to you by the deceased member’s superannuation fund. If the death benefit is channeled through the deceased’s estate for your ultimate benefit as a non-tax dependent beneficiary, you won’t be required to pay the Medicare Levy.

|

Component

|

Maximum Tax rate

|

|---|---|

|

Tax-free

|

Tax-free

|

|

Taxable – taxed element

|

15%

|

|

Taxable – untaxed element

|

30%

|

Should the death benefit be distributed to you as an income stream, the scenario changes depending on age considerations. If either the deceased or you are over age 60, the income payments you receive will be tax-free. However, if both are under age 60, the taxable portion of the income you receive will be taxed at your marginal tax rate, though you will benefit from a 15% tax offset. Take note; the tax rules might shift if the pension includes an element untaxed, such as those from some government superannuation funds.

Account Based Pensions

You can use your superannuation to start an account-based pension once you retire (or meet another condition of release).

This allows you to receive income as regular payments (usually monthly, quarterly, half yearly, or yearly).

You must be paid a minimum income each year. Still, you generally have the option to make additional lump sum withdrawals at any time. You can also stop (fully commute) your pension and roll it back to the accumulation phase of superannuation, roll it over to start another income stream, or take it as a lump sum. However, there are restrictions on taking lump sum withdrawals if your pension is being paid under the transition to retirement rules.

Your account-based pension will stop once the account balance is exhausted, the pension is commuted, or upon your death unless there is an automatic continuation of the pension to a nominated reversionary beneficiary.

Transfer Balance Cap

The Transfer Balance Cap (TBC) limits the total amount of superannuation you can transfer from your accumulation super account to a tax-free ‘retirement phase’ account.

The general transfer balance cap is currently $1.9m for the 2024-2025 financial year.

However, if you commenced a retirement income stream prior to 1 July 2023, your personal transfer balance cap may be less than $1.9m. Pensions paid under transition to retirement rules are not a retirement phase pension and are therefore not affected by the transfer balance cap.

Income Payments

You can select how much income to receive each financial year, giving you the flexibility to meet your individual needs. The only rules on how much pension must be taken are:

- You must receive an income payment at least once each financial year.

- A minimum level of income must be paid each year based on a percentage of the account balance at the commencement of your account-based pension and again at the start of each financial year.

If your income stream commences part-way through a financial year, or is commuted before the end of a financial year, the minimum payment is pro-rated for that year.

The minimum payment factors are shown in a certain table (with the resultant dollar amount being rounded to the nearest $10).

|

Age

|

Income Factor

|

|---|---|

|

Under 65

|

4%

|

|

65 – 74

|

5%

|

|

75 – 79

|

6%

|

|

80 – 84

|

7%

|

|

85 – 89

|

9%

|

|

90 – 94

|

11%

|

|

95 and over

|

14%

|

If your pension is being paid under transition to retirement rules, it is subject to a maximum income limit of 10% of the account balance.

Taxation of an Account Based Pension

Earnings added to a retirement phase pension account (excluding transition to retirement pensions) are tax-free. No tax is payable within the superannuation fund, which can help boost the effective earnings rate.

Every withdrawal (income or lump sum or death benefit) from a pension is split into taxable and tax-free components in the same ratio that applied when the pension commenced. The tax on each component depends on your age, as shown in the below table:

Taxation Of Income Payments

|

Age

|

Component

|

Taxation Treatment

|

|---|---|---|

|

Any age

|

Tax-free

|

No tax

|

|

60 or older

|

Taxable – taxed element

Taxable – untaxed element |

No tax

Marginal tax rate*, less 10% offset |

|

Under age 60

|

Taxable – taxed element

Taxable – untaxed element |

Marginal tax rate*, less 15% tax offset

Marginal tax rate* |

* Plus, Medicare Levy

Taxation of Lump Sums – Over age 60

If you are 60 or over the tax on lump sum withdrawals is shown in the table below for the 2024-25 financial year.

|

Component

|

Threshold

|

Tax rate

|

|---|---|---|

|

Tax-free

|

All

|

0%

|

|

Taxable (element taxed)

|

All

|

0%

|

|

Taxable (element untaxed)

|

Up to $1,780,000

Over $1,780,000 |

15%*

45%* |

*Plus Medicare Levy

Taxation of Lump Sums – Under your preservation age

If you are under your preservation age, the tax on lump sum withdrawals is shown in the table below for the 2024-25 financial year.

|

Component

|

Threshold

|

Tax rate

|

|---|---|---|

|

Tax-free

|

All

|

0%

|

|

Taxable (element taxed)

|

All

|

20%

|

|

Taxable (element untaxed)

|

Up to $1,780,000

Over $1,780,000 |

30%*

45%* |

*Plus, Medicare Levy

If you withdraw a taxable component and tax is paid on this amount, it is added to your assessable income and may impact your entitlement to other tax offsets or benefits. This may mean you pay more tax than you expect on other income in that year.

Transition to Retirement Pensions

Upon attaining the preservation age condition of release, you can commence a Transition to Retirement (TTR) income stream with preserved benefits or a mix of preserved and non-preserved benefits.

If you are over the preservation age but still working, you might not have full access to your superannuation. However, you might be eligible to start an account-based pension under the Transition to Retirement (TTR) rules, sometimes referred to as a Transition to Retirement Income Stream or TRIS..

Once you reach 65, or inform your super fund that you have met a condition of release before turning 65, your TTR pension transitions into a ‘TTR pension in retirement.’ This transition subjects your pension to the same conditions applicable to an account-based pension.

Transition to Retirement Income Payments

The person can select how much income to receive each financial year. This allows flexibility to meet individual needs.

The governing rules only stipulate that an income payment must be made at least once each financial year. A minimum level of income must be based on a percentage of the account balance at commencement, and each 1 July must be paid. If the income stream kicks off part-way through a financial year, or is commuted before the year’s end, the minimum income payment is pro-rated for that year.

|

Age

|

Income Factor (2023-24)

|

|---|---|

|

Under 65

|

4%

|

For a TTR pension, the maximum income you can opt for is 10% of the account balance, and no lump sum withdrawals are allowed..

The pension will cease when the account balance dwindles to nil, or you request the funds be rolled back to the accumulation phase or another pension account. You can commute the pension anytime, with the funds rolled back to the accumulation phase. Cash withdrawals are only permissible upon meeting a condition of release.

Taxation of Income from a TTR Pension

Any withdrawal you make (be it income, lump sum, or death benefit) from a pension will be split into taxable and tax-free components, maintaining the same ratio as when the pension commenced. The tax on each component is contingent on your age, as outlined below:

|

Age

|

Component

|

Taxation Treatment

|

|---|---|---|

|

Any age

|

Tax-free

|

No tax

|

|

60 or older

|

Taxable – taxed element

Taxable – untaxed element |

No tax

Marginal tax rate*, less 10% offset |

|

Under age 60

|

Taxable – taxed element

Taxable – untaxed element |

Marginal tax rate*, less 15% tax offset

Marginal tax rate* |

* Plus, Medicare Levy

Earnings added to your pension account are taxed at the same rate as those that apply to the accumulation phase of superannuation.

Want to Learn More? View our Superannuation Services here and our Retirement Planning services here.

Table of Contents

Start Planning Today

Our initial consultations are complimentary, and in your first meeting with us, we gain an understanding of you, your personal and financial position and unique goals and objectives. We also encourage you to ask us questions, about our company and culture, to ensure we are the right financial partner for you.